Worksite’s Innovative Health Plan

There’s no denying the challenges employers face when it comes to finding affordable, quality healthcare for employees. With our Innovative Health Plan, the days of large renewal increases and the annual scramble to find affordable coverage are finally over.

Bringing new options to employers with a unique approach to health coverage

Affordable Pricing

No Underwriting

PHCS/MultiPlan Network

Low Participation Requirements

Under 50 Employees?

Over 50 Employees?

All plans are ACA compliant.

A Closer Look

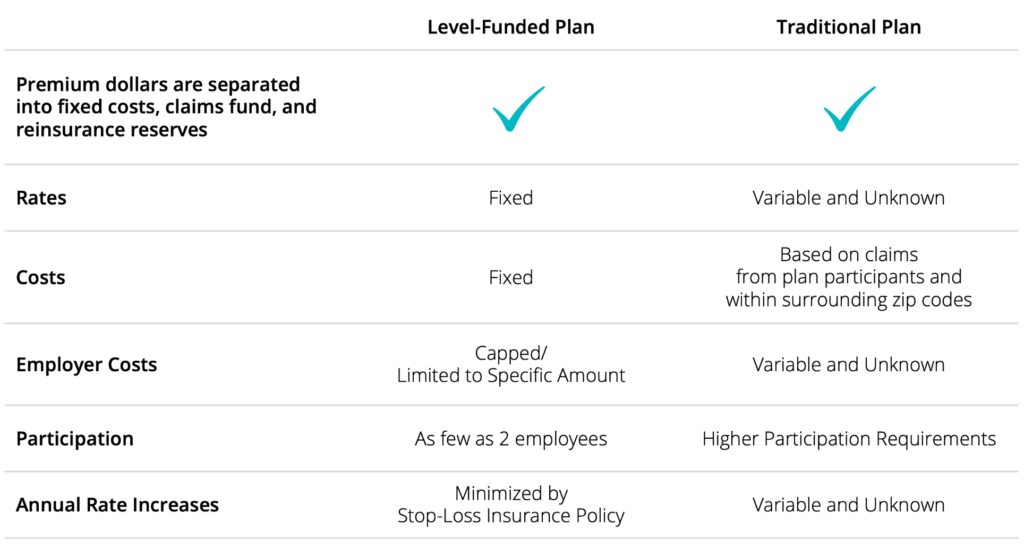

The days of accepting the traditional healthcare monopoly, enduring large renewal increases, and scrambling to find affordable coverage are over. Worksite’s innovative approach is the first step in taking control of your company’s healthcare future.

Frequently Asked Questions

Worksite’s Innovative Health Plan is a level-funded health plan, so technically there is no carrier. The plan uses the PHCS/Multiplan Network, a national network of doctors and hospitals that are under contract to provide services.

The PHCS/Multiplan Network is a network of thousands of doctors and hospitals under contract to provide services to anyone in the network. Established in 1980, the PHCS/Multiplan Network has providers in all 50 states.

To locate providers participating in the PHCS/Multiplan Network, call the Patient Advocacy Center at 800.292.0536 or visit www.hstconnect.com. Online registration is not required to look up providers.

Innovative Health is the name of our plan. It is not a carrier or name a provider would recognize. Employees should tell their provider’s office this new insurance is part of the PHCS/MultiPlan Network.

The provider’s billing department should call 866.862.6935 to confirm eligibility. This is often more efficient than working with the office’s front desk. The phone number can also be found on the back of each PHCS card issued to your employees.

No, this is a group plan offered by Worksite. Upon enrolling, each group (client) becomes their own plan sponsor. Claims management and eligibility questions are handled by S&S Health:

https://secure.healthx.com/ssh.aspx866.862.6935

For office visits, copays are paid at the time of service. A bill will be sent to the employee to collect copays for additional services, like imaging.

There is a one-time $25 processing fee to set up your group. Worksite will pay that to S&S Health and pass the cost through on your PEO invoice.

There is no underwriting required. All groups are automatically approved.

A minimum of two participants are required per enrolled group. If an enrolled group falls below two enrolled employees for 60 consecutive days within the plan year, the employer will receive a 60-day plan termination notice from the insurance company. To remain on the plan, the employer must return to the minimum of two enrolled employees within the 60-day termination window.

If your company has less than 50 full-time equivalents, you are not required to contribute to the plan.

If you are an Applicable Large Employer with more than 50 full-time equivalents, you must make the plan affordable according to IRS guidelines by contributing a minimum of 50%.

Regardless of which month your company begins coverage, the renewal will be January 1.

Yes. Worksite and its partners administer the plan. We will pay and reconcile invoices and handle all terminations, additions, and changes.

Yes, premium deductions begin the month prior to the effective date.

If Worksite pays a termed employee’s premium for the second month after their termination, the amount of premium paid will be charged back to the employer. To prevent these charges, Worksite should be made aware of employee terminations when they occur.

The amount not collected can be charged to the employer and collected from the employee when they have sufficient wages. Worksite can work with the employee to spread out the payments to avoid a significant impact on their paycheck.

If they get an Explanation of Benefits, it will come from S&S Health. If it is a bill, it will come from the provider (doctor or hospital) directly.

Many medications, including maintenance drugs, are available by mail order. Others, like antibiotics, can be picked up at a local pharmacy.

Staying in-network is highly recommended. Reimbursement for out-of-network services is not guaranteed. Employees can request reimbursement by sending a copy of the receipt from their provider and a picture of the front of their PHCS card to: S&S Health, PO Box 18233, Cincinnati, OH 45218. The address can also be found on the back of their PHCS card. Employees should refer to the Schedule of Benefits for more information.

Schedule of Benefits

Let's get started!

Plan participants, call S&S Health at 866.862.6935

to confirm if a service is included.